Affording a Car Quick Facts

Today’s car sales market is a mixed bag of not-great and not-so-good news. What should be happening doesn’t seem to be happening — at least not yet. New car prices remain at the manufacturer’s suggested retail price (MSRP) with some discounting despite higher interest rates. Used car prices are falling, but inventory is thin. It’s an interesting market for buyers with a trade-in. The situation leaves many car industry analysts scratching their heads.

As consumers, one of the questions we seek guidance on is, can you afford to buy a car right now? Our answer is yes, with a few conditions. Let’s dig a little deeper and see if we can ease some of the uncertainty.

What’s Happening With Car Prices Right Now?

We will need to start with current pricing trends to get a handle on your ability to afford a car right now.

What Is the Average Price for a New Car?

According to data from Cox Automotive, the parent of Kelley Blue Book, the average price a buyer paid for a new car in November 2023 was $48,247.

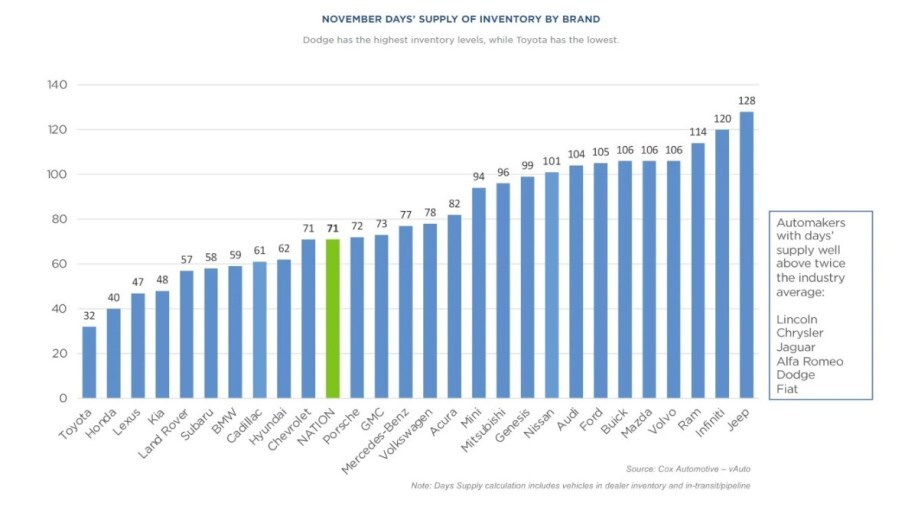

Cox Automotive vAuto data shows that inventory shortages at the end of 2023 still hamper Toyota, Honda, Lexus, Kia, and Land Rover. But you’ll find plenty of new Lincoln, Chrysler, Jaguar, Alfa Romeo, Dodge, and Jeep vehicles.

Whether new or used vehicles, negotiating a better price from dealers today is much more challenging than before the COVID-19 pandemic. Simple economics tells us that prices will remain elevated for those vehicles until the supply of models exceeds demand. At the same time, others could land you a better deal.

What Is the Average Price for a Used Car?

According to Cox Automotive, the average used car transaction price in November 2023 was $26,553. However, trends show some pain points for used cars that may persist through the first part of 2024. Wholesale prices dealers pay for used cars at auction began falling. However, the nationwide inventory of used cars for sale is shrinking. Those aren’t great trends for shoppers looking to buy used vehicles.

Where Are Car Prices Going?

Rising interest rates began forcing down transaction prices for new and used vehicles last year. But interest rates for car buyers are steadily declining, and that’s great news.

Yes, new car inventories started returning to normal, but some carmakers still face depleted stock on select models like the Toyota Camry or Honda CR-V. Odds are prices will remain high on those and other Asian brand vehicles in the short term.

In the used car market, future supply will be constrained. Lean inventories of used vehicles will keep prices higher. Shoppers priced out of the new-car market and into the used adds to the pricing pressure.

RELATED ARTICLE: When Will New Car Prices Drop?

How Do Car Loan Interest Rates Impact Purchase Price?

Every car loan has some moving parts that, when added together, define how good a deal you scored on your vehicle purchase. The transaction price is the final cost of the vehicle after the down payment, trade-in, fees, taxes, and so forth. It also reflects your success in negotiating down the manufacturer’s suggested retail price (MSRP).

What do stubbornly high car prices have to do with interest rates? For consumers, finding the lowest interest rate possible is more important than ever when striving for car affordability.

How Do Interest Rates Impact Vehicle Cost?

Interest rates on used car loans will almost always be higher than on loans for new cars.

Using the car payment calculator from our sister company, Autotrader, let’s make a quick comparison to see how the interest rate (the cost of the borrowed money) can impact a car’s affordability. Remember that your credit score, credit history, and job history all impact the lowest interest rate for which you qualify.

New Car Interest Rate

According to Bankrate, as of this writing, the average interest rate on a 48-month new-car loan is 7.65%. Let’s say you want to finance $30,000 for 48 months at the average rate. That works out to $727 per month for a total of $34,919 paid over the life of the loan. In other words, you will pay a total of $4,919 in interest over 48 months. Financing that same amount for 48 months at 4.99% works out to $691 per month and $33,156 over the 48-month life of the loan. Shaving just 2.66% from the interest will save $1,763 over the life of the loan.

Used Car Interest Rate

Using Bankrate figures, the average interest rate on a 48-month used car loan is 8.35%. Let’s work that out to see the payments for financing $20,000. The monthly payment would be $492 per month with a total payback amount of $23,594 or $3,594 in interest over the life of the loan. Doing the same math with an interest rate of 7.35% interest works out to monthly payments of $482 and a total payback of $23,145. Dropping 1% from the interest rate saves $449 over 48 months.

Low APR Car Loans Are Out There

No-interest loans are harder to find, but digging for the best financing deal is a sure way to make car buying more affordable. Allyson Harwood, a senior editor for Kelley Blue Book, offers her take on the current financing environment.

“There are plenty of great deals out there. We’ve spotted lease deals with low monthly payments on small and midsize SUVs. Furthermore, there are several great deals with a low APR. And, if you are looking for a truck, some manufacturers have offers of low APR financing plus cash back.”

RELATED: 10 Best Car Deals

How Much Car Can I Afford?

Pinpointing the exact car transaction price you can afford isn’t an easy process. On the contrary, it is a tiresome and sometimes painful experience. Determining how much car you can afford requires being honest about income and truthful about your spending. This little ride around the block on the reality bus isn’t pleasant for many of us. However, potential car buyers must do it. At least we have the Autotrader Car Affordability Calculator to help with some of the math. Autotrader is the sister site to Kelley Blue Book.

How to Make a Monthly Budget

Making a monthly budget requires figuring out how much you spend each month. Here are some of the expenses you should include:

- Mortgage or rent

- Utilities (electric service, gas service, and so forth)

- Telephone (this is all costs related to any landlines (if you still have one), smartphones, and internet broadband costs)

- Insurance (home, renter’s, auto, life, medical, and any other insurance not deducted from your paycheck)

- Loan and credit card payments

- Groceries

- Entertainment (meals out, movies, cable, streaming services, and so on)

You will need to establish your net income and create a list of your monthly expenses. That is, whatever you bring home after taxes and any deductions for retirement, company-sponsored insurance, and so forth. Subtracting your itemized expenses from the net take-home pay is the amount left for automobile and miscellaneous expenses. Remember, you will always have extra expenses over and above your regular itemized obligations. Never overextend your budget for a car.

Once you have determined what amount you can realistically put toward a car payment after calculating the cost of fuel, car insurance, and monthly upkeep, you will know the monthly car payment you can afford. Try using our 5-year cost-to-own tool to get estimates for car maintenance and more. Plug that and the other requested information into the Autotrader calculator to land on a transaction price you can live with that’s in your budget.

TIP: Try comparing car insurance using our tool to get a policy estimate before you buy.

How to Afford a Car in This Economy

There is no real secret to affording a car in the current economy. Essentially, you must be willing to do the research and exercise patience.

“It might take a little work to find the specific model and trim level you are looking for without a dealer markup,” Harwood said. “Therefore, don’t be afraid to talk to multiple dealerships to find what you want. And don’t be afraid to walk away if you don’t like the offer a dealer puts in front of you.”

Thinking Outside the Box to Create an Affordable Car Loan

Getting a little creative can also go a long way in discovering an affordable path to getting a car. Here are a few ideas:

- Settle for a model that’s not in short supply: You may need to compromise your wants for your needs. If you have your heart set on a Toyota, Kia, Honda, or some other tough-to-get brand or model, you might consider setting your sights on something more available. Buick, Jeep, and Ram, among others, have healthy inventories of vehicles. Not only will dealers have a better selection, but they will probably be more willing to wheel and deal. They are also more likely to be offering incentives on some models.

- Check out 2023 models: Sure, you want a new 2024 model. But you may be able to find a newer 2023 version of the model you want for thousands less. Again, some solid financing and leasing deals may be available on last year’s models.

- Shine up that trade-in: Jonathan “JB” Bradley, currently the internet manager and formerly the finance manager of Ed Voyles Kia in Chamblee, Georgia, says you can make up most of your lost ground on (dealer) market adjustments by trading in a car. “It’s a big variable,” he said. “There’s not a whole lot you can do about interest rates, but you can make up most of your lost ground.”

- Buy new: Even if you’ve been considering a used car, consider a new one. The interest rates for new are at least a little lower.

- Consider certified pre-owned (CPO) cars: You’ll save money because the vehicle is used and it’s also backed by a CPO warranty.

- Larger down payment: The more money you put down on a loan, the lower the monthly payments and the less interest you will pay. However, Bradley says it’s a tradeoff. “Every $1,000 (down) saves you $17,” he approximates. “You need to ask yourself if it’s worth it?” That money may do you more good in your savings account if you need a cushion as the economy worsens.

- Take out a line of credit: If you own a home, a home equity line of credit (HELOC) is another option to consider. “With a line of credit,” Bradley said, “you get a better tax benefit, plus you get to use that money to your advantage.” Moreover, you can tailor the terms of that line of credit to fit your budget. We recommend you talk to your financial planner or tax advisor before taking this route. A HELOC uses your home as collateral for the loan, and buying a new car might not be worth the risk of losing your home.

- Make more payments: An idea hatched by the mortgage industry is to pay your loan every two weeks rather than once a month. In other words, if your monthly car payment is $700, pay $350 every two weeks. It’s like paying an extra month’s payment each year. The car loan is paid earlier; consequently, you save on interest.